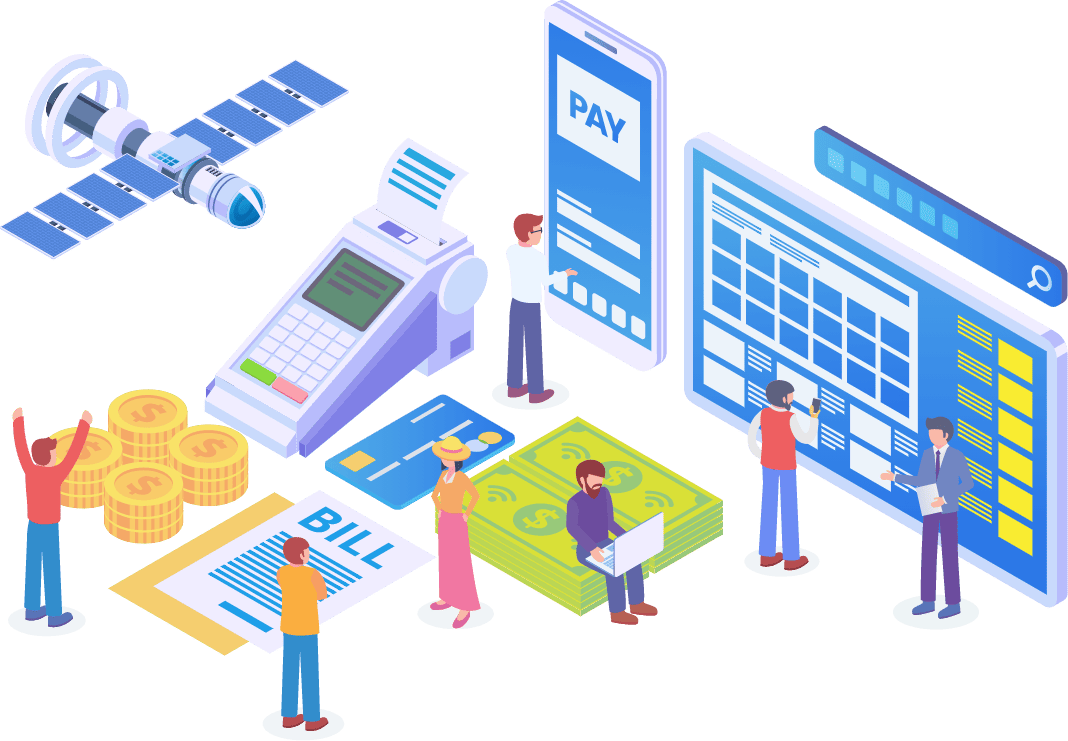

eHUB™ is aligned with Canada’s newly developed Real-Time Rails (RTR) and will provide 24x7x365 payments and have ISO 20022 messaging to support data-rich payments. eHUB™ will provide more robust, client-centric options that deliver industry-leading payments and eCommerce solutions.

eHUB™ is designed to help clients mitigate significant capital expenditures and intensive in-house development by providing a robust, flexible and comprehensive digital payments hub with optimum service availability and security. Due to the power of aggregation, Everlink eHUB™ offers clients an attractive business proposition, providing superior cost savings, risk mitigation, innovation and speed-to-market with volume-related economies of scale and operational efficiencies.

eHUB™ for e-Commerce will allow Payment Service Providers (PSPs) to offer their customers 3 unique ways to pay using Interac at checkout from the Online and Mobile app checkouts that include In-Store, In-App and In-Browser. Another feature that eHUB™ provides, essential to PSPs looking to implement cloud-based strategies, is an alternative method of connecting to Everlink that isn’t ISO8583. eHUB™ also supports all the major mobile wallets, such as:

- Apple Pay

- Samsung Pay

- Google Pay

Features & Benefits

- Iso20022 Enabled

- Interac® E-Transfer Api V3.5 Certified

- Api-Led Connectivity

- Integrated Fraud Management

- Domestic In-App/In-Browser Debit

- Visa Direct/Mastercard Send Capabilities

eHUB™ will offer all clients and partners the latest Interac® e-Transfer v3.5, a fast, secure and convenient way to send money in Canada using online banking. Fintechs, Financial Institutions, and Credit Unions using eHUB™ can transfer the funds using established and secure banking procedures. Transfers are almost instant, depending on your financial institution’s policies and procedures.

- Iso20022 Enabled

- Interac® E-Transfer Api V3.5 Certified

- Api-Led Connectivity

- Integrated Fraud Management

- Domestic In-App/In-Browser Debit

- Visa Direct/Mastercard Send Capabilities

Additional Features Included:

- Real-Time Payments

- Facilitate Payments For Any Industry

- International Remittances

- Ecommerce & Digital Wallets

- Configurable

- Validated

- Developer-Friendly

Integrated fraud management solution

In addition to all of the features and benefits included, eHUB™ provides the ability to include an integrated, award-winning, real-time fraud monitoring solution – eDETECT™.

eDETECT+™ is capable of receiving, reviewing and detecting fraud within digital banking channels such as mobile/desktop banking, money send platforms, or from banking hosts themselves. Both non-monetary and monetary transactions are absorbed, profiled and reviewed. Non-monetary transactions are used as early indicators of potential account takeover (ATO) situations, while money movement transactions are reviewed in real-time with capabilities to decline and prevent fraud before losses are incurred by our client Issuers. Additional capabilities include:

- Transaction Monitoring

- Anti-Money Laundering (Aml)

- Know Your Customer (Kyc)

- Account Takeover (Ato)

- Employee Misconduct

Looking to transform your digital payments solutions?

If you’re interested in testing Everlink’s eHUB™ API, or would like a free discovery engagement with Everlink’s Product Leaders, contact us today!